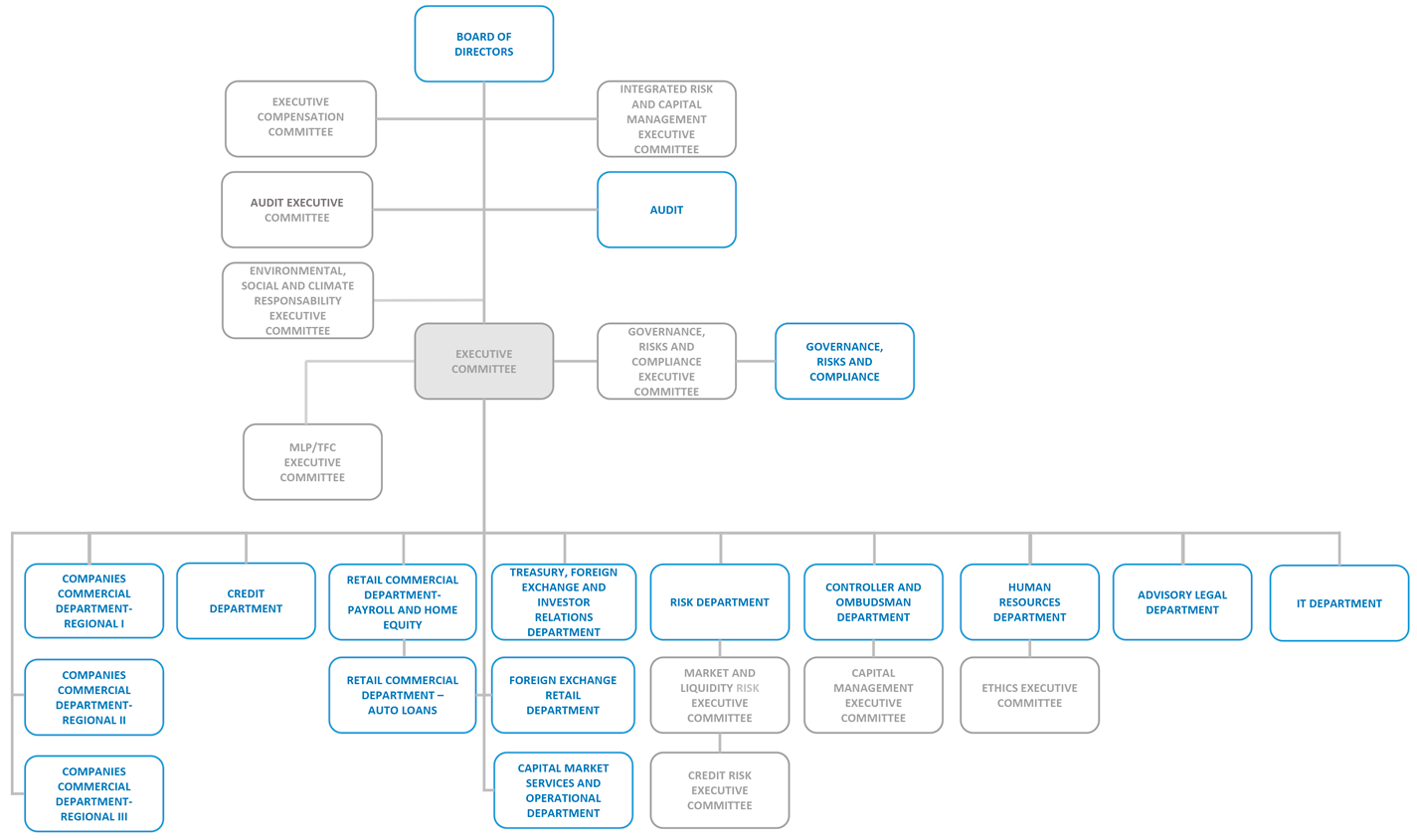

Establish the rules and guidelines that, taking into account the principles of excellence and corporate governance, will guide actions to ensure compliance with current regulations. This assures the implementation of actions and access to the information necessary for the continuous and integrated management of risks and capital.

Establish the rules and guidelines that, taking into account the principles of excellence and corporate governance, will guide actions to ensure compliance with current regulations. This assures the implementation of actions and access to the information necessary for the continuous and integrated management of risks and capital.

Oversee the internal control and risk management processes, the internal audit activities and the activities of the independent audit firm contracted by the Bank.

Evaluate compliance with the ethical principles and guidelines of conduct established in the Code of Conduct that must be followed by all employees of Banco Daycoval and the Daycoval Group's companies, suppliers and clients, with a view to fostering respect and compliance with the Organization's Code of Conduct.

Monitor and control the capital held by the Bank, assessing its need to face exposure to the risks assumed in its operations, as well as plan the capital targets and eventual needs, taking into consideration its strategic objectives.

Ensure excellence regarding Banco Daycoval's MLC/TFC (Money Laundering Prevention/Anti-Terrorism Financing Crimes) compliance pursuant with the current legislation as well as the guidelines and strategies to mitigate the likelihood of image (reputational), legal and operational risks.

Ensure compatibility between the Institution's strategies and its Credit Policy, as well as monitor the “Exposure Levels” defined by Senior Management.

Identify, control and manage market and liquidity risks, ensuring consistency between the risks taken and the risk appetite defined by the Bank.

Propose the rules and guidelines for compensation of the Organization's Statutory Officers, based on the performance goals established by the Board of Directors itself.

Establish guidelines to ensure compliance with current regulations, inhibit incompatible and/or unnecessary risks to the Daycoval Group's entities, enhance the effectiveness of the business areas, improve the effectiveness of controls and minimize the impact on the risks to which they are subject.

The committee is made up of the the executive board, funding, foreing exchange and retail executive board, risks board (CRO), human resources board, representative of the area of grc- social, environmental and climate risk and, as its responsabilities, but not limited to: